October 2021 is a Seller's market!

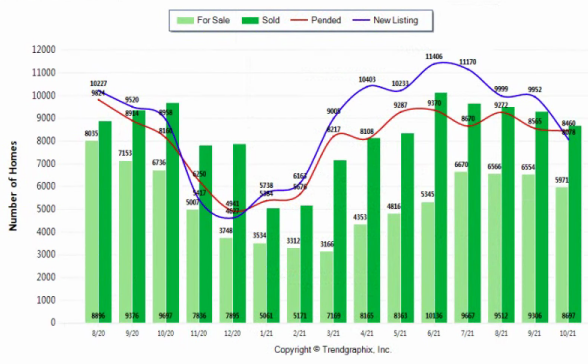

The number of for sale listings was down 84% from one year earlier and down 0.2% from the previous month. The number of sold listings decreased 3.3% year over year and decreased 4.6% month over month. The number of under contract listings was down 4.3% compared to previous month and up 1.3% compared to previous year. The Months of Inventory based on Closed Sales is 0.7, down 13.1% from the previous year.

The Average Sold Price per Square Footage was down 0.8% compared to previous month and up 20.4% compared to last year. The Median Sold Price decreased by 2.3% from last month. The Average Sold Price also decreased by 1.3% from last month. Based on the 6 month trend, the Average Sold Price trend is "Depreciating" and the Median Sold Price trend is "Depreciating".

The Average Days on Market showed an upward trend, a decrease of 40% compared to previous year. The ratio of Sold Price vs. Original List Price is 103%, an increase of 3% compared to previous year.

It is a Seller's Market

Property Sales (Sold)

October property sales were 9066, down 3.3% from 9376 in October of 2020 and 4.6% lower than the 9507 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 599 units of 8.4%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventory is down 0.2% compared to the previous month

Property Under Contract (Pended)

There was an decrease of 4.3% in the pended properties in September, with 9028 properties versus 9432 last month. This month's pended property sales were 1.3% higher than at this time last year.

Brokers are detecting indecisiveness by some buyers who are getting mixed “work from home” messages from their employers. The hesitancy, coupled with cooler, wetter weather and increases in mortgage rates were likely factors in slower listing and sales activity during October. Brokers reported 10,620 pending sales last month, a drop of 3.8% from a year ago and a decline of 6.2% from September. Pending sales volume fell in 13 of the 26 counties in the MLS report, but tight inventory could be hampering the ability of buyers to find their dream home. The latest report shows there were 9,983 closed sales during October. That was 823 fewer completed transactions than a year ago (down 7.6%) and 306 fewer than September (down about 3%). The cooler activity may be the result of several factors but also expressed some optimism. While the overall slowdown in the market is seasonal and can be attributed to people being priced out of the market, as well as a slight uptick in interest rates, supply chain issues experienced with construction materials late this summer are beginning to normalize.

The cooling might also be impacted by employees who are hesitant to buy as they are getting mixed “work from home” messages from some of our region’s top employers. There are questions about how much house they will need for a home office or whether they will be working from a centralized location. While changing policies are creating indecisiveness for some buyers, others are pursuing secondary home markets, choosing quality of life over the need to be near an urban core – “betting that the ‘work from home’ option is here to stay. House hunters were able to select from 9,219 new listings MLS added to inventory last month. That was 1,209 fewer than the same month a year ago for a drop of 11.6%. Compared to September, new listing activity shrunk nearly 19%. At month end, there were 6,588 active listings in inventory, down 23.6% compared to a year ago, and the smallest selection since June, but the selection improved by double digits in eleven counties. Measured by months of supply, there was less than three weeks of supply area-wide (0.66). Eleven counties, including eight in the Puget Sound region, had less than one a month of supply. Fourteen counties reported more than a month of supply, still well below the industry’s “balanced market” indicator of four-to-six months. Inventory is still very tight. Outer counties tended to record slightly more inventory. Only four counties had more than two months of supply: San Juan (2.14), Okanogan (2.61), Adams (3.11) and Ferry (5.4).

Even though inventory is scarce in many areas, brokers reported solid activity.

As the weather cools, the housing market intensity heats up for each new listing. Buyers want to lock in a great interest rate. The intensity of activity in the Puget Sound area is “either approaching or already at spring 2021 levels, depending on the local area,” adding buyers will face constrained inventory until March 2022. The listing inventory in Kitsap County continues to stay low (0.72 months of supply) which leads to steady open house traffic and multiple offers on correctly priced new listings. We are approaching our seasonal low in inventory. Each year, as the year closes out, potential home sellers wait until the new year to put their homes on the market. In reality, a home listed now will have higher viewership since the buyer pool has not gone down. With the pace of this market a correctly priced home offered now would probably be off the market by Thanksgiving, allowing the seller to have a quiet holiday. A concern is expressed about the “erosion of affordable housing” in Kitsap County. As prices continue to rise and with interest rates also “shifting into uphill mode, the affordability index is headed downhill.”Some buyers are not buying now because they think there will be a price collapse in our future, but the nagging question is what would cause one?”

Kitsap County continues to have restricted inventory and a multitude of buyers outstripping supply. Noting that county’s supply is slightly higher than most surrounding counties, an anomaly is taking place. Many resale homes have adjusted asking prices downward while new construction prices continue to rise. We are seeing a tremendous influx of builder interest. Some homes being added to inventory have not been in the marketplace for 10 to 40+ years as post-Vietnam War-era workers retire and look to resize their housing. Investors are also active. They are contacting everyone who owns a home or land in Kitsap and Mason counties offering cash and a quick close (and intending to convert some properties into rentals) because they know the value of this market. Consequently, buyers entering the market must be prepared with all their finances, pre-approvals and supporting documents available in order to compete.

Would-be buyers will find prices for single family homes and condos are 15% higher than a year ago, with most counties reporting double-digit gains. Area-wide, the price for last month’s closed sales was $575,000, which was $75,000 higher than twelve months ago. For single family homes (excluding condos), prices rose 16.3% YOY, rising from $515,000 to $599,000. Condo prices were up about 11.3%, increasing from $395,000 to $439,475. King County was the exception among the metro areas with double-digit price gains. Prices were up about 9.5% from twelve months ago, increasing from $685,000 to $750,000. Within the county, prices in Seattle registered the smallest gain at 5.3% while Vashon prices jumped more than 33% compared to a year ago. Homes that sold in the Southeast part of the county surged 19.7%, followed by the Southwest segment at 17.7%. On the Eastside, where the median price was more than $1.1 million, year-over-year prices were up 17.3%.

The trends provide a mixed message as to whether demand will return to the cities as quickly as anticipated. With millennials looking for value and increased opportunities to purchase a home in the suburbs, it could be an interesting few months as to whether the lifestyle of the city and employers can change the balance of demand back to the city. Buyers may find some relief with condominiums, although the selection is limited. From an affordability standpoint, many buyers have been forced into the condo market, but the inventory is severely depleted. Active listings of condos are down about 55% from a year ago, shrinking from 2,079 properties to 941. About seven of every 10 condos are located in King County. The median price on condos that sold last month system-wide was $439,475. That’s up 11.3% from the year-ago figure of $395,000. In King County, prices rose modestly, from $459,970 to $475,000 (up about 3.3%). Condo inventory was comparable to both a year ago and a month ago in Kitsap County, while prices spiked 22% from a year ago.

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Tips, please tune in to our Facebook Live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com